Position Closer

Automated electricity trading on the spot market

Close your positions on the spot market automatically – at the right time.

Do you want to close open positions on the intraday electricity market in a price-saving manner – for example, to ensure balancing group loyalty and reduce your balancing energy risk? We offer you a specially developed algorithm for automated trading on the intraday market, which can be easily connected to your system.

What does the Position Closer offer you?

The Position Closer allows you to automate electricity trading. Open positions on the spot market for electricity are closed cost-effectively and in a way that protects the market price with an AlgoTrader. Vattenfall provides the necessary infrastructure for this. This saves costs and administrative effort for your company.

How does it work?

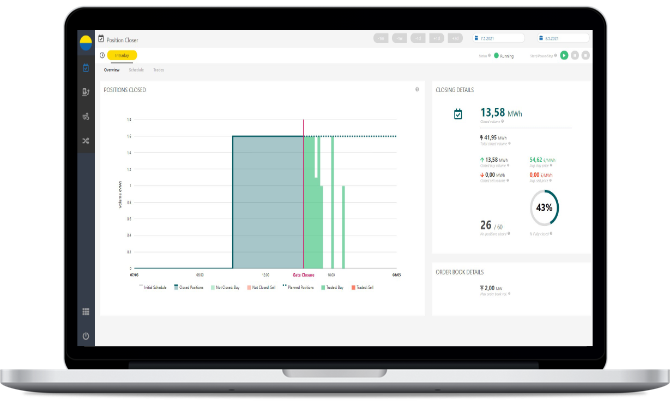

By means of market orders, the volumes transmitted via a standard interface (API) are automatically placed on the electricity market and processed. A dashboard provides you with a live overview of the processes.

Who profits from the Position Closer?

The Position Closer is of interest to grid operators, power plant operators and energy suppliers, among others, who want to close positions on the spot market automatically – for example, to ensure balancing group loyalty within the framework of Redispatch 2.0.

Whitepaper: Flexibility

The expansion of renewable energies requires more flexibility – from all parties involved. What does flexibility mean and how can producers and industrial companies benefit from their own flexibility?

Find out more in our whitepaper!

Services and advantages at a glance

- Safe and tested algorithms

- 24/7 online electricity market access and 24/7 process monitoring

- Monitoring of regulatory and compliance guidelines

- Minimal effort due to simple connection via API interface

- Test environment available

- Takeover of energy industry tasks by Vattenfall possible

Automated Trading

Trading the intraday market with algorithms

<a href="https://youtu.be/UFQYVqJjUZg" target="_blank""><img alt="Thumbnail YouTube Intraday Handel" src="https://energysales.vattenfall.de/uploads/media/original/02/2432-Thumbnail-YT-Automatisierter-Handel-Intraday-UFQYVqJjUZg.jpg?v=1-0&inline=1"></a>

Note: If you click on the thumbnail of the video, you will leave our website and be redirected to www.youtube.com. Please refer to the privacy policy of Youtube or Google.

API Interface

Via our API programming interface, which enables different software programs to communicate with each other, we receive data in connection with our Position Closer Algo and make data available to you. This requires easy-to-read and detailed documentation. The following link will provide technical content with clear instructions on how an API works, how it works, and how to use it.

<span class="h3">Did you already know?</span>

In intraday trading, very short-term electricity products can be traded within one day. It is divided into auction trading and continuous trading. In auction trading, 15-minute contracts are traded for the following day until gate closure at 3 pm. Continuous trading is closest to the delivery time: it opens at 4 p.m. and allows trading of continuous hourly, half-hourly, quarter-hourly and block products.

Automated trading is gaining in importance, especially in times of flexible generation and offtake and volatile prices. Algorithms specially tailored to the needs of customers take over tasks such as closing open positions on the spot market. In this way, customers avoid balancing risks and optimize generation, production and storage facilities.

The algorithms can be easily integrated into the customer's system landscape via an API interface. In operation, they are continuously monitored by experienced traders.

At Vattenfall, we offer Flex Monetizer in addition to Position Closer. It supports the marketing of flexibilities in generation and consumption.